IS PAWA FOR YOUR COMPANY?

Despite the recent advances in technology, many MFIs, especially in Africa, continue to face significant challenges in managing operations and information. Two key reasons for this situation are the unavailability of suitable MIS applications for microfinance in Africa and the high cost of IT solutions.

PAWA is a cloud-based integrated multi-branch centralized core banking system with cutting-edge technologies such as branchless banking system (smartphone and POS) and SMS banking included as standard features, all with a flexible pricing structure and highly secure.

Whether you are a microfinance bank, a Savings & Loans company, a rural bank, or a rapidly growing MFI, you can rely on PAWA to help maximize growth, increase productivity, and mitigate risks.

HOW IT WORKS: 5 EASY STEPS

CORE MODULES

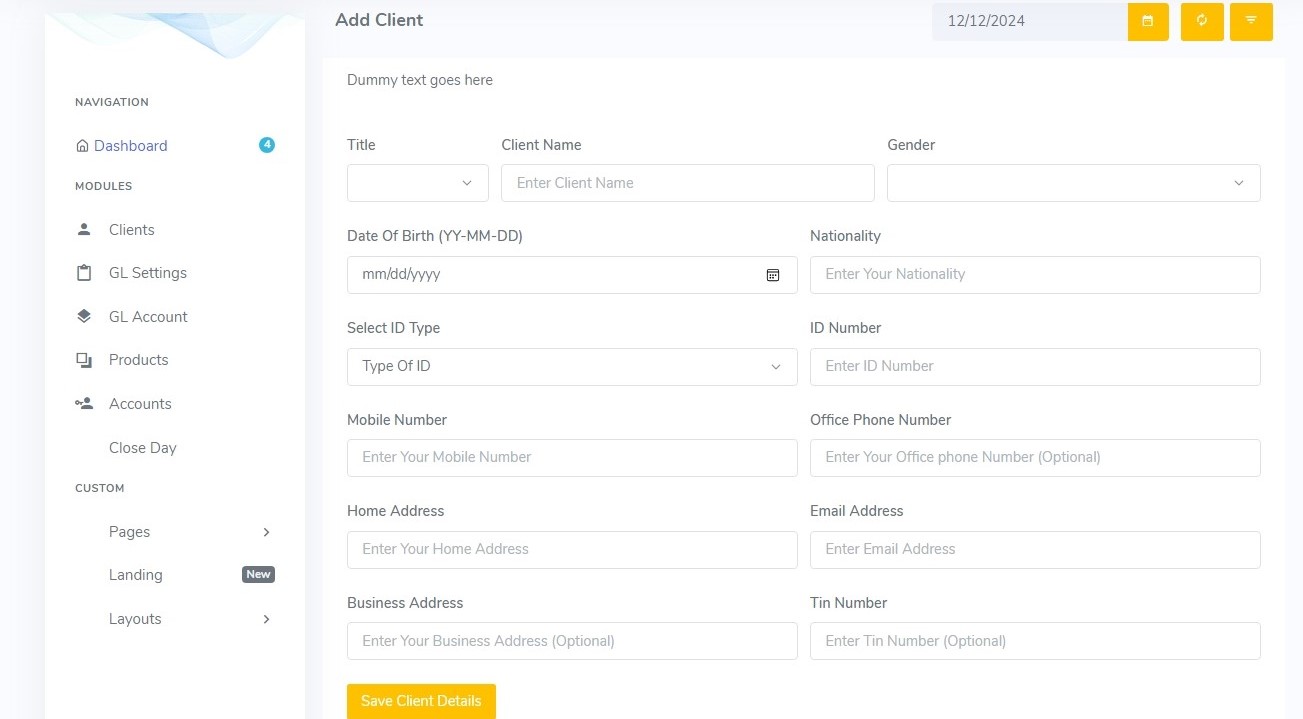

Customer Management

Customer product information, Customer contact management, Signing up new customers, Customer identification, Customer authentication, Client withdrawal limits management and Customer communication history

management

Account Management

This module allows the user to create accounts for existing customers with valid identification numbers has created using the Customer Maintenance module. The new account can be created for any product that

has been defined in the system. Account enquiries can also be done using this module.

Product Management

This module is used to create products of all categories in the system. The module allows the parameterization of product features including interest rates, frequency, interest calculation type, GL Control

account, interest receivable and interest received etc. It applies to loans, savings and deposits.

G/L Management

This is the main module used to define and create G/L accounts. The account created can be assigned as an asset, liability, income or expense. Statement for various transactions affecting any G/L account can

be viewed and printed using this module. Accounts can be restricted as required.

Loan Management

Multiple loans per customer and loan repayment collection, Display payment plans for customers (individuals and groups), Track customer behaviour on repayment for rating and Track outstanding loan instalments

and view customers complete transaction history

Deposits Management

Supports multiple savings accounts per customer, Collect payments for savings and deposits accounts, Support different types of savings accounts, Pay out savings to customers and Support opening of new

accounts

Treasury Management

Provides real-time information on inflows and outflows by each loan officer every day, Provides real time overview of money available in each branch and Supports secure and auditable disbursements and

collections by loan officer via unique PINs

Transaction Definition

This module allows rural and community banks, microfinance institutions, savings and loans companies and banks to set different customized transaction codes anytime with customized definitions and specify

whether the code should be used for credit transactions or debit transactions.

Transactions

Cash Transactions, Internal Transfer, Batch Internal Transfer, Inter branch or meeting point cash transactions, Inter branch or meeting point transfer, Outward Credit and Inward Credit

Account Classification

Different classification categories have been created in the system using this module. However, the organization can create more classes as per own requirement. Example: a class called Customer Meeting Point

can be created with sub classes as Meeting Point A and Meeting Point B.

Bank Holidays

Various dates which are holidays and on which the institution is closed to the public will be marked as non-working days using this module such that the system will not schedule any loan repayment or allow

any transaction and start of day procedure to be executed on those dates.

User Access Rights

This module is used to define the system users (each with a username and password), the access rights and required permissions including posting limits, PAR monitoring where for instance the branch manager

see all loan officers’ the performance when individual officers are limited to only seeing their own.

System Auditing & Matching

This is a special module designed to assist the audit department. The processes under this module will check for differences in the accounting system and report them. Identified differences can optionally be

corrected by a click of a button, or further investigated to ascertain its origin.

System Administration & Processing

Close of Business Processing End of Day Processing, Start of Day Processing, End of Month Processing, End of Financial Year Processing and End of Calendar Year Processing

Reporting

Loan reports, Transaction register, General Ledger reports including Trial Balance, Balance Sheet and Profit & Loss, Regulatory reports, Customised reports for investors and partners and Social performance

reports

Operational Mode

PAWAmobile is designed to operate in two modes, providing robust communication Online mode using internet Offline mode (without internet in areas where there is no cellular coverage or internet availability)

Loan Calculator

PAWAmobile comes fully integrated with a loan calculator for better interaction with clients and value-added services This will make the work of field loan officers much easier

Notification

Customer notification for every transaction via SMS Customer notification for every transaction via mobile printer (connected through Bluetooth) Print customer account statement Communication of special

offers to customers Birthday wishes

Com. Channel

Communication with the server via, GSM, WIFI, GPRS and 3G/4G/5G and Communication with the mobile printer via Bluetooth

Access Control

Password protection for each user account, Customer identification via photograph and User access rights and restrictions, and roles are clearly defined

Encryption

Communication between Head Office and branches is encrypted (VPN support), Communication between server and devices is encrypted and All sensitive data stored on devices is encrypted and fully secure

Audit Tracking

All changes in the system are documented: who did what and when, Data retention period for deleted data can be configured and Overall management of the company’s key resources is significantly improved,

leading to better productivity

Employee Performance

Reports on start and end of work per field officer every day, Overview of number of visits performed by each field officer, Average duration of field visits by each field officer in the branch and throughout

the company and Other indicators

Device Management

Assign specific users to all company devices, Centralised provisioning and configuration of mobile devices, Remotely disable device or users of a particular device and Centrally configure device and server

behaviour

CLIENTS THAT TRUST PAWA

Gifty Adubea Ekuban, To have our product live and working within less than half a year is phenomenal. Without Pawa, we simply wouldn’t have a working product today.

Aminu Danbala, Thanks to Pawa's modern capabilities and flexibility, we are able to disrupt the banking industry and deliver a Netflix-like experience to our customers.

Daniel Ankrah, By selecting Pawa to handle our core banking functionalities, we can now focus on the development of value-added services.

FRANK OSEI, Amazing software, user-friendly interface and easy to use.

HENRY ELETUO, Highly recommended PAWA for all your agency banking – it has lots of features and transforms our workflow!

ROOSEVELT HASSAN, PAWA has incredible features and a user-friendly interface that makes it easier to use.

JOSEPH SOSUNG, The PAWA support team went above and beyond to provide us with the best customer service experience ever!

GIFTY OSEA, “Your product is THE port in the storm.”

JOE MENDS, “You are by far the best vendor support group I’ve ever worked with.”

DOUGLAS ACKWAH, It’s never fun talking to technical support unless it’s with PAWA – we know they’ll help with any problems.

Kwabena Owusu-Ansah, We were all very impressed with the installation process. Through effective team collaboration, we successfully deployed PAWA to perfectly meet all of our requirements.

OUR PACKAGES

PAWA comes in 4 different packages to suit the profile of your business, both in terms of technical requirements and budget. You can switch between packages anytime you wish as your business requirements dictate.

Basic

per month Unlimited Branches

Unlimited Branches- 1 User

-

Up to 1,000 borrowers

Up to 1,000 borrowers

Up to 1,000 depositors

Up to 1,000 depositors

Standard

per month Unlimited Branches

Unlimited Branches- Up to 4 Users

-

Up to 5,000 borrowers

Up to 5,000 borrowers

Up to 5,000 depositors

Up to 5,000 depositors

Premium

per month Unlimited Branches

Unlimited Branches- Up to 10 Users

-

Up to 10,000 borrowers

Up to 10,000 borrowers

Up to 10,000 depositors

Up to 10,000 depositors

Platinum

per month-

Unlimited Branches

Unlimited Branches

- Up to 50 Users

-

Up to 50,000 Borrowers

Up to 50,000 Borrowers

-

Up to 50,000 Depositors

Up to 50,000 Depositors

Every PAWA package comes complete with all features, including the innovative PAWAmobile app which enables agents on the move to carry out banking operations on mobile devices, even in remote areas with no internet connectivity.